Tail Risk Metrics: AI vs. Traditional Models

Explore how AI-driven tail risk models outperform traditional methods in accuracy, speed, and adaptability for effective risk management.

Explore how AI-driven tail risk models outperform traditional methods in accuracy, speed, and adaptability for effective risk management.

Inefficient data management poses significant regulatory and operational risks for asset managers, emphasizing the need for modern solutions.

Integrate data, AI, and modular systems for a comprehensive risk management strategy to stay ahead in today’s fast-paced financial landscape.

Outdated batch processing systems are costing financial firms millions. Transitioning to real-time data is vital for competitiveness and compliance.

Explore how agile third-party integrations can enhance legacy systems, improving efficiency, compliance, and decision-making without costly replacements.

Explore critical questions asset management firms must address for responsible AI governance and transparency in investment decisions.

Explore the hidden costs and risks of legacy data systems in financial institutions, and learn how to calculate true TCO for successful modernization.

Legacy financial systems hinder growth and innovation; modular, AI-driven solutions offer a path to agility and competitive advantage.

AI-powered volatility prediction tools enhance risk management by providing real-time insights, faster detection, and regulatory compliance.

Explore how real-time systemic risk detection empowers financial institutions to make faster decisions, ensure compliance, and protect investments.

Explore how real-time dashboards revolutionize market insights, enabling faster decision-making and smarter investment strategies with live data integration.

Real-time analytics revolutionizes asset management, enabling faster decisions, better compliance, and improved operational efficiency over legacy systems.

Asset management firms must modernize legacy systems to meet client demands and regulatory standards while managing risks effectively.

Explore how AI is revolutionizing intraday volatility monitoring, surpassing legacy systems with speed, accuracy, and real-time insights.

Explore how AI is transforming compliance gap analysis, offering faster, more accurate, and scalable solutions compared to traditional manual methods.

Legacy systems drain resources, expose organizations to security risks, and hinder growth. It’s time for modernization to stay competitive.

Explore how sentiment analysis transforms financial decision-making by interpreting market emotions and enhancing trading strategies.

Explore essential steps for implementing AI fraud detection systems to enhance security, meet regulations, and combat evolving fraud tactics.

Explore how deep learning is revolutionizing asset management by enhancing factor timing, improving returns, and addressing market complexities.

Explore how deep learning revolutionizes portfolio risk management by enhancing predictive accuracy and adapting to market dynamics.

Explore how AI enhances cybersecurity in financial systems by detecting threats, preventing fraud, and streamlining responses to cyber attacks.

Bringing You Faster, Smarter Investment Insights We’re excited to share that Accio Analytics is now working with FMP (Financial Modeling…

Explore how synthetic data is revolutionizing fraud detection in finance, enhancing accuracy, reducing false positives, and ensuring privacy compliance.

Explore how machine learning revolutionizes price prediction in finance, enhancing accuracy, insights, and decision-making strategies.

Learn how AI and Machine Learning driven predictive rebalancing enhances portfolio management through real-time analytics, risk management, and cost efficiency.

Explore how AI transforms real-time market analysis, enhancing decision-making through rapid data processing, risk management, and actionable insights.

Explore how edge computing is revolutionizing high-frequency trading by enhancing speed, security, and scalability for financial firms.

Explore how Deep Reinforcement Learning is revolutionizing trading strategies through real-time market adaptation and smarter decision-making.

Explore how AI revolutionizes factor-based asset selection by enhancing speed, accuracy, and risk management in investment strategies.

Explore how machine learning enhances trade execution by improving speed, reducing costs, and optimizing decision-making.

Explore how AI behavioral models revolutionize dynamic portfolio rebalancing with tailored strategies for varying market conditions.

Explore the ethical risks of AI in finance, including bias, data security, and compliance challenges, and learn how to address them effectively.

Explore how AI enhances portfolio management through real-time tracking, risk analysis, and automated decision-making for investment professionals.

Learn how AI risk heatmaps enhance portfolio management with real-time insights, automated reporting, and customized risk assessments.

Enhance your trading performance by tracking key metrics that optimize execution speed, cost efficiency, and overall trade management.

Explore how real-time event detection in financial markets leverages AI to identify trends and enhance decision-making with speed and accuracy.

Batch processing in finance leads to delays, missed opportunities, and increased risks. Real-time systems are essential for staying competitive.

Explore how AI is reshaping portfolio management with faster decision-making, enhanced risk management, and personalized investment strategies.

Navigate the complexities of AI portfolio management with a comprehensive risk management checklist to safeguard your investments.

Explore 8 essential market analysis tools that enhance decision-making for investment professionals, featuring AI insights and real-time analytics.

Explore how AI enhances compliance in portfolio management by improving accuracy, enabling real-time monitoring, and reducing risks.

Explore how machine learning surpasses traditional analytics in portfolio management, offering real-time insights and dynamic risk management.

Introduction: The New Norm in Financial Markets In the financial world, timing isn’t just important—it’s everything. Investment firms that operate…

In today’s fast-paced financial industry, professionals encounter several challenges that hinder their ability to make informed decisions, promote growth, and…

In today’s fast-paced financial world, making accurate and timely decisions is critical. However, many businesses struggle with the complexity of…

In the fast-moving world of asset management, where every second counts and where accuracy is critical, we really need to…

While we all recognize the need to replace older technology to provide new features and more automation, the decision to…

All industries and most companies experience some degree of “boom and bust” as they weather economic cycles. Good times allow…

In today’s data-driven world, organizations recognize the critical role of analytics in driving informed decision-making and gaining a competitive edge….

In today’s data-driven world, organizations heavily rely on analytics to drive informed decision-making and gain a competitive edge. However, the…

Language models like GPT-3, developed by OpenAI, are powerful tools capable of generating human-like text based on the input they…

Investment risk management is crucial for any investment firm that wants to succeed in today’s competitive and complex market. However,…

Accio Analytics is very pleased to announce the addition of Munir Shocair as our new Business Development lead. With his…

My last update on the growing Technology Gap that exists in many firms was the third in a series of…

In my last update on the growing Technology Gap that exists in many firms, I wrote about conducting regular software…

In my last update on the growing Technology Gap that exists in many firms, I wrote about the benefits of…

Accio Analytics, a leading provider of investment risk management solutions, has unveiled its latest enhancement, a series of Risk Ex-Ante…

I have received a fair number of comments on my article about the Technology Gap that exists in most companies,…

Most organizations focus on generating profit, which is appropriate as companies need to make money to stay in business. However,…

In today’s rapidly evolving financial landscape, investment firms face numerous challenges. One critical aspect that often gets overlooked is the…

What if I told you that 50-80% of the people in an organization spend their time on mundane data quality…

For many years I was responsible for what we used to call DRP – Disaster Recovery Planning. Back then, technology…

Most of us are living with legacy technology for many of our middle- and back-office functions that was never designed…

Most of us working in an investment management shop will be familiar with this scenario: There is a powerful and…

Also known as the “Big Quit” and the “Great Reshuffle”, these terms all refer to the tendency for significant numbers of employees to leave their jobs during and after the COVID-19 pandemic at rates never seen before.

One of the aspects of Portfolio Management that is sometimes misunderstood or over-complicated is Attribution. Specifically, Fixed Income Attribution. One…

Whenever a client approaches us with a specific challenge we can customize the platform to their requirements

Since the onset of 2022, the markets have been suffering losses. While all investors are impacted, many are wondering what…

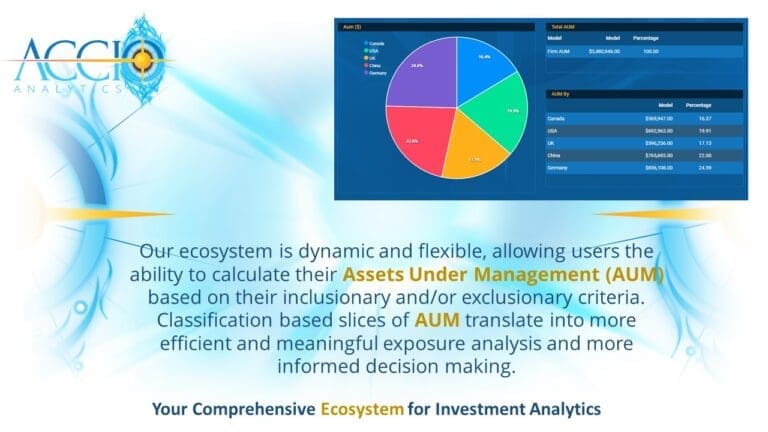

Accio Analytics’ Ecosystem is designed to deliver a smooth flow of data from the root to final result. The example…

Want to try Accio Analytics’ criteria-driven AUM Analytics? Request a walkthrough at https://lnkd.in/eyEy4rb9 Follow us on LinkedIn for more. https://lnkd.in/eVQm5fAq

Want to try Accio Analytics’ Limitation Free Attribution Analytics? Request a walkthrough at https://lnkd.in/eyEy4rb9 Follow us on LinkedIn to learn more…

Want to see the Accio Analytics Ecosystem in action? Request a walkthrough at https://lnkd.in/eyEy4rb9 Follow us on Linkedin for more. https://lnkd.in/eVQm5fAq

The accuracy of your performance analytics should never be a question. As an investment manager your time should be spent…

Seamless consumption and reconciliation of data to produce robust analytics can set you apart from your competitors. This is possible…

Applying risk calculations to your funds to generate key metrics should not have limitations. At Accio, we recognize there shouldn’t…

When it comes to investment analytics any limitations to interpreting the data can be detrimental. At Accio Analytics, we recognize…

Effective utilization of both Internal Rate of Return (IRR) and Time Weighted Rate of Return (TWRR) calculations as measures of…

Two of the most common concerns raised by asset managers over the years have been Limitations in selecting the frequency…

At Accio Analytcs, we value the insights provided by our clients. Your feedback has contributed tremendously to the design of…

Always at the forefront of innovation, Accio Analytics’ utlization of Microsoft Azure guarantees our scalability is second to none. No matter your…

As a portfolio manager, lengthy software implementations and upgrades shouldn’t be your main focus. Satisfying your clients should be. Accio Analytics’…

Accio Analytics’ focus: Attribution, Risk, Security Analytics and more Options to utilize Accio Analytics either as a standalone analytics tool…

Driven by a commitment to simplicity, empowerment, expertise, and innovation, Accio Analytics was founded to revolutionize risk management strategies for…

Based on the feedback we have received, and frustrations heard in conferences and forums, Accio Analytics has already made headways…

[vc_row][vc_column][vc_column_text] While Model is a term that is interpreted differently across the industry, Accio Analytics has a specified use of…